The GAAP formula determines a business’s profit. What it does not take into account is the affect of human behavior. If you are a business owner, you will want to watch this video to learn how your perception of expenses impacts your profits.

Read MoreParkinson’s Law states that demand for a resource increases to meet supply. This theory can also be applied to your finances. Watch now to learn how your expenses can actually decrease when this law is applied.

Read MoreSome people believe there is an opportunity cost in converting to a Roth IRA. Don’t be fooled! Listen to learn why this is false.

Read MorePaying taxes once, is your obligation. Paying taxes twice, is your fault. Watch now to make sure you are aware of tax implications of converting to a Roth IRA.

Read MoreEveryone has a Risk Number whether they know it or not. Your tolerance for market volatility is unique.Some investors are suited for a more safe and predictable journey, others are built for the fast lane. Which strategy is right for you?

Read MoreFrom tax-focused investment strategies to helping you plan for your business to retirement planning and withdrawal strategies, we can help bridge your working years to your retirement years through our tailored approach.

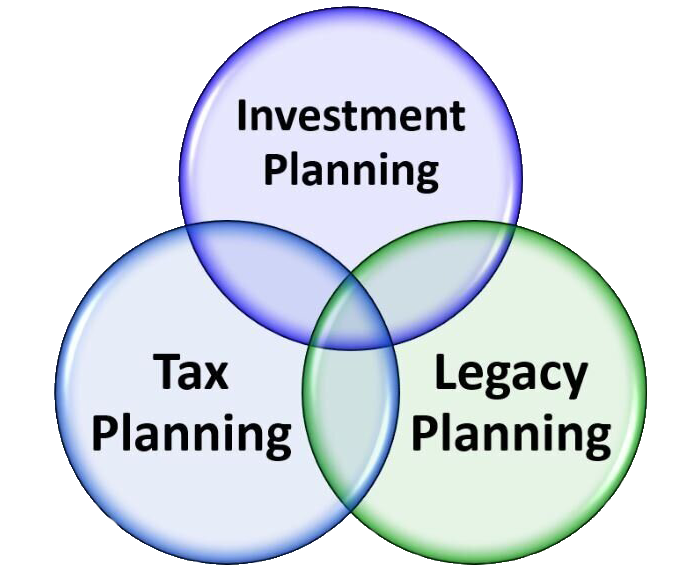

Read MoreWe’ve mapped out a comprehensive approach for every aspect of a financial plan. These topics are needed to address tax-intelligent financial solutions.

Read MoreFrom tax deadlines to gift and estate tax exclusions, use this helpful guide to review key financial data and deadlines for 2024.

Read MoreHere are six essential areas our team is talking to our clients about and what you should address to make the most of your financial situation before the upcoming Tax Day.

Read MoreThe risk of receiving lower or negative returns early in a period when withdrawals are made from an investment portfolio is known as sequence of return risk. This can impact the amount of income you receive in retirement.

Read More